Retail exchanges 1.951 billion, totalling Rs136 trillion from July to September

December 21, 2024

Portion of advanced installments in Q4 of FY24 expanded to 27%.

Retail exchanges observer 8% flood in volume in Q1 of FY25.

251 million (13%) exchanges handled through OTC channels.

KARACHI: In the midst of the public authority's difficult endeavors to digitize the economy, the State Bank of Pakistan (SBP) has uncovered critical headways in installment biological systems and foundation with 87% of all retail exchanges being handled by means of computerized channels, The News detailed Saturday.

In its quarterly installment frameworks survey for the main quarter of the financial year 2025, the national bank on Friday said that computerized channels detailed a sum of 1.699 billion retail exchanges, while over-the-counter (OTC) channels contained the leftover 13% adding up to 251 million exchanges.

The report additionally noticed a 8% expansion in the volume of retail exchanges arriving at 1.951 billion and totalling Rs136 trillion during the time of July to September.

As far as worth, the portion of advanced installments rose from 24% in the final quarter of FY24 to 27% adding up to Rs36 trillion, though OTC installments — through bank offices and branchless financial specialists — represented 73% totalling Rs100 trillion.

The report frames that the vital target of any country's installment framework is to give protected, productive, and dependable installment choices for moving assets, buying labor and products, settling installments, and working with the development of money.

The installment framework in Pakistan assumes a vital part in guaranteeing clients approach productive and secure installment choices.

The country's installments foundation incorporates Crystal — constant gross repayment (RTGS) framework, the Raast moment installment arrangement, 33 banks, 12 microfinance banks (MFBs), five installment framework administrators, specialist organizations (PSOs/PSPs), four electronic cash establishments (EMIs), and 12 branchless financial players (BBs), alongside fintech and outsider specialist co-ops.

Together, these substances offer consistent and secure asset move and settlement choices for Pakistanis.

Installments in Pakistan can be isolated into two fundamental classes: enormous worth installments, handled through the RTGS framework, and retail installments, which include normally low-esteem exchanges that happen during standard business or day to day existence exercises.

Since its beginning in 2022 and up to the furthest limit of the principal quarter of FY25, Raast has handled 848 million exchanges, totalling over Rs 19 trillion, and keeps on developing at a predictable speed, as per the report.

In Q1 FY25, both the volume and worth of exchanges expanded by 17% contrasted with Q4 FY24, with the volume arriving at 197 million exchanges and the worth adding up to Rs4.7 trillion. The day to day normal of exchanges arrived at 3 million. Toward the finish of the quarter, there were 39.5 million enlisted Raast IDs. Raast upgrades the effectiveness of moment installments for the two people and organizations.

Portable banking applications given by banks, MFBs, BBs and EMIs assumed a vital part in this development, with 1,301 million exchanges adding up to Rs19 trillion being brought out through these applications during the quarter, mirroring a 11% ascent in volume and 14% in esteem. The aggregate number of versatile banking application clients developed by 4%, arriving at 96.5 million from 93 million in the past quarter.

The report noticed that web based business is likewise arising as a vital part of Pakistan's computerized installments, with a 29% increment in web-based internet business installments.

Of the 118 million web-based online business installments during the quarter, 91% were led through computerized wallets, implying a shift from conventional card-based frameworks.

Supplementing this development, the quantity of retail location (POS) terminals extended to 132,224, empowering 83 million exchanges worth Rs429 billion.

The ATM network developed to 19,170 units, working with 243 million exchanges worth Rs3.9 trillion, keeping up with its vital job as a money withdrawal channel.

Endeavors to incorporate underserved sections have picked up additional speed, with branchless financial specialists assuming a basic part in broadening monetary administrations, particularly in rustic and distant regions.

More than 693,178 specialists handled 28 million billion installments, versatile top-ups and 75 million money store and withdrawal exchanges during the quarter.

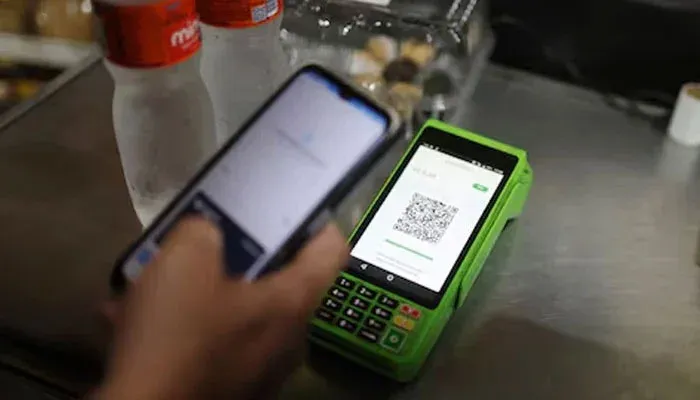

Retail traders tolerating computerized installments saw a 16% development, driven by branchless financial drives that empower installments through versatile wallets, QR codes and other computerized instruments.

These advancements highlight the significance of option monetary diverts in spanning financial differences across districts.